Featured Galleries USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

Holodomor Posters

Holodomor Posters

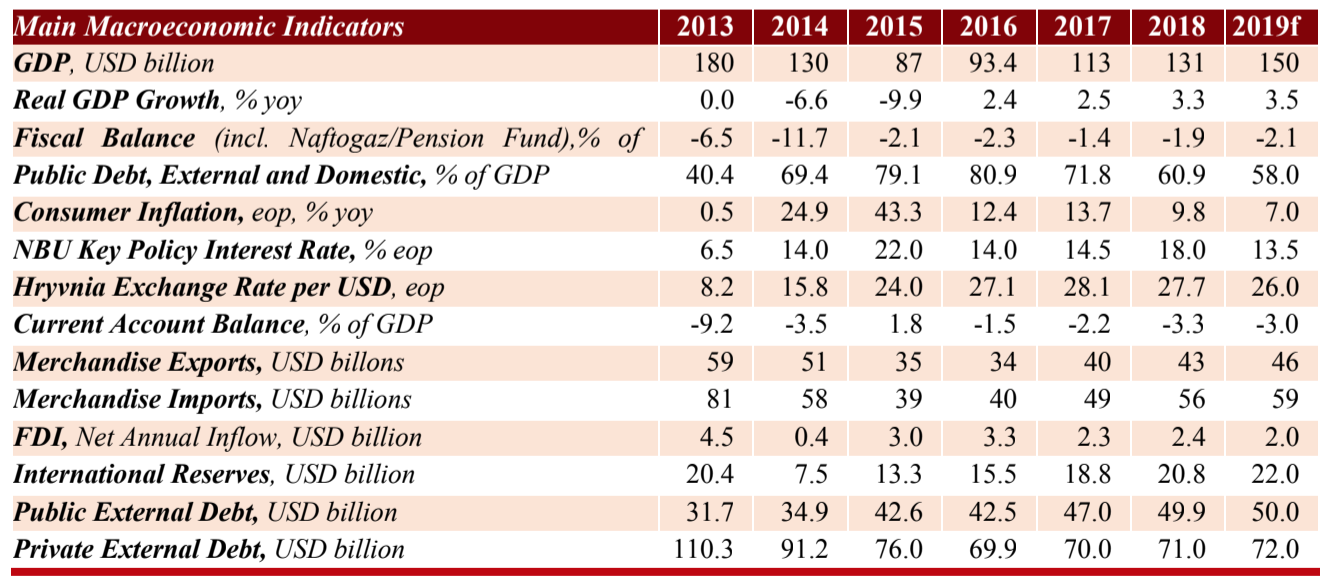

UKRAINE - MACROECONOMIC SITUATION REPORT – DECEMBER 2019

ANALYTICAL REPORT: by Oleg Ustenko, Julia Segura, Valentyn Povroznyuk, Edilberto L. Segura

ANALYTICAL REPORT: by Oleg Ustenko, Julia Segura, Valentyn Povroznyuk, Edilberto L. Segura

SigmaBleyzer private equity investment management firm & The Bleyzer Foundation (TBF), Kyiv, Ukraine

Published by U.S.-Ukraine Business Council (USUBC),

Washington, D.C., Thu, Dec 19, 2019

WASHINGTON, D.C. - The "Ukraine Macroeconomic Situation – November 2019" analytical report with several charts and graphs IS ATTACHED to this communication and can be found at the link below. The monthly Macroeconomic Situation report is prepared by SigmaBleyzer, www.SigmaBleyzer.com, and The Bleyzer Foundation (TBF), www.BleyzerFoundation.org, Kyiv, Ukraine, who are long-time members of the U.S.-Ukraine Business Council (USUBC), http://www.USUBC.org.

EXECUTIVE SUMMARY: (the entire December 2019 Macroeconomic Report Situation found in the PDF document: SB_Ukr-Monthly_Ec_Report_December_2019(1).pdf

Executive Summary

1) On December 9, the leaders of France, Germany, Ukraine, and Russia gathered in Paris to resume negotiations to resolve the conflict in Donbas. The meeting yielded only modest successes: there were agreements on a complete prisoner exchanges by the end of the year, and on the implementation of a permanent ceasefire.

2) On December 7th, the IMF announced that a staff level agreement with Ukraine had been reached on the Extended Fund Facility program. The Facility will amount to USD 5.5 billion and will be provided to the country during a 3-year time period. Prior Board conditions include ensuring that Privatbank and other nationalized banks will not be returned to the previous owners.

3) Real GDP growth in the 3rd quarter of 2019 reached 4.2% yoy, a rate much higher than expected. Current economic growth was driven by domestic demand for household consumption, with retail trade growing by 11.3% yoy and output construction by 20.8% yoy. Both were supported the higher real and nominal wages.

4) The consolidated fiscal budget was in deficit in October. The cumulative consolidated budget balance from the beginning of the year turned negative at UAH 0.7 billion in January-October.

5) Consumer inflation continued to decelerate in October, with the overall inflation index dropping 1.0 percentage points to 6.5% yoy, supported by the revaluations of the Hryvnia.

6) In the banking sector, Hryvnia deposits posted a good performance in October. National currency deposits grew by 13.1% yoy. However, bank lending activities was sluggish in October. Both hryvnia loans and foreign exchange loans denominated in USD saw little changes in growth dynamics.

7) In November, the UAH/USD exchange rate appreciated during the month. Appreciation resulted from increased inflow of dollar from non-residents (who continued purchasing sovereign bonds denominated in Hryvnias) and from exporters, mainly agricultural and metallurgical producers.

8) In October 2019, the deficit of Ukraine’s current account declined by 8.4% yoy to USD 651 million. The deficit was partly covered by USD 503 million of financial inflows (principally FDI of USD 332 million). The overall balance of payments had a deficit of USD 146 million, declining international reserves to USD 21.9 billion.

The entire December 2019 Macroeconomic Report Situation found in the PDF document: SB_Ukr-Monthly_Ec_Report_December_2019(1).pdf