Featured Galleries USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

Holodomor Posters

Holodomor Posters

COSA enhances focus on the Baltic-Black Sea region

and the Middle East

COSA, Kyiv, Ukraine, Feb 10, Wed, 2020

COSA, Kyiv, Ukraine, Feb 10, Wed, 2020

COSA is a member of U.S.-Ukraine Business Council

Since its establishment in 2014, COSA has been serving its clients around the world providing upscale intelligence solutions related to compliance, security, market expansion and investment matters. Our global reach and international expert network have always been seen as our strongest points, and this year we are happy to enhance these features by expanding our presence in Central and Northern Europe as well as the Middle East – the regions we have traditionally covered, but that require more on-the-ground activities considering our stronger focus on the Baltic-Black Sea region.

Since its establishment in 2014, COSA has been serving its clients around the world providing upscale intelligence solutions related to compliance, security, market expansion and investment matters. Our global reach and international expert network have always been seen as our strongest points, and this year we are happy to enhance these features by expanding our presence in Central and Northern Europe as well as the Middle East – the regions we have traditionally covered, but that require more on-the-ground activities considering our stronger focus on the Baltic-Black Sea region.

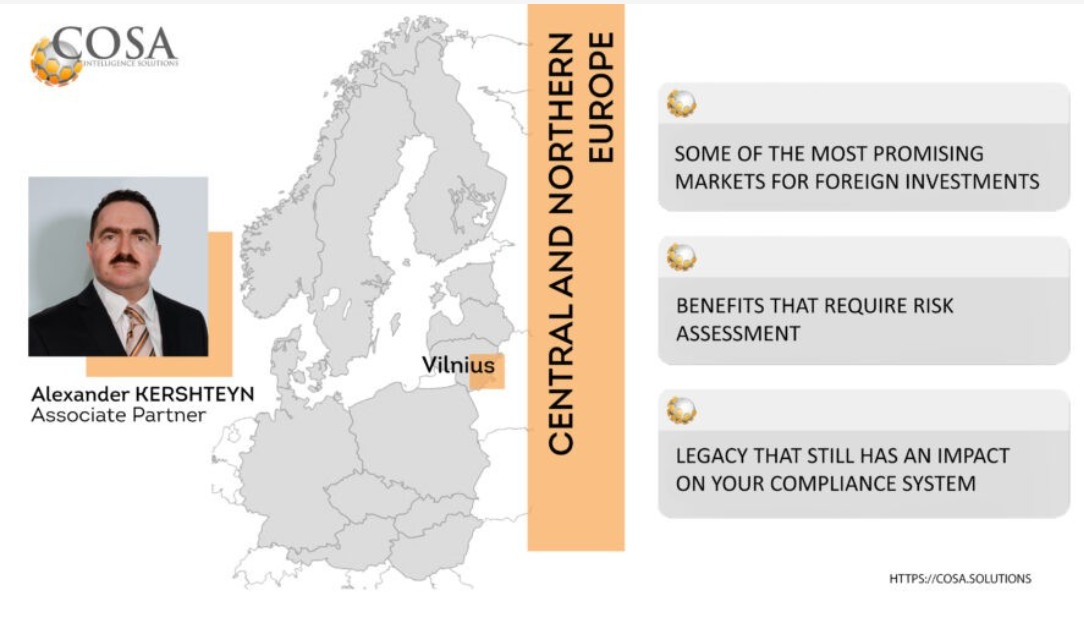

We gladly introduce Alexander Kershteyn, Associate Partner at COSA, based in Vilnius, Lithuania, and Ayse Ece Kutsev, Representative in the Middle East, based in Istanbul, Turkey, who will lead the operations in the mentioned regions.

The Baltics, as a foreign direct investment destination, look attractive, but are still too dependent on the emerging markets and Russia in particular in terms of energy and exports. This makes your know your client’s client (KYCC) procedure a bit more sophisticated considering the active sanction regimes, geopolitical security matters and overall compliance issues. The banking sector has improved lately, but is still an area that requires special attention. Finally the inow of IT businesses from the Former Soviet Union countries, require some deeper due diligence on the UBOs and their afliates at home. Just across the sea from the region’s most compliant jurisdictions of Scandinavia, the business environment in Central Europe, including some of the most developed countries in the European Union, is yet not as transparent as it could seem. The sensational Wirecard case is probably just the juiciest one. Some of the banking sector issues previously predominantly typical for the Baltic countries have somehow shifted to Central European jurisdictions, and money from the FSU seeking new westward routes is seen as the main cause of those processes. Russian names among the UBOs of real estate, IMEX, energy and numerous FinTech companies, are also indicated as red ags by AML/CFT systems. The overcrowded Central European business environment makes it challenging to identify untrustworthy or simply dangerous third parties, and the understanding excessive multi jurisdictional information ows is a key to Read more

The Baltics, as a foreign direct investment destination, look attractive, but are still too dependent on the emerging markets and Russia in particular in terms of energy and exports. This makes your know your client’s client (KYCC) procedure a bit more sophisticated considering the active sanction regimes, geopolitical security matters and overall compliance issues. The banking sector has improved lately, but is still an area that requires special attention. Finally the inow of IT businesses from the Former Soviet Union countries, require some deeper due diligence on the UBOs and their afliates at home. Just across the sea from the region’s most compliant jurisdictions of Scandinavia, the business environment in Central Europe, including some of the most developed countries in the European Union, is yet not as transparent as it could seem. The sensational Wirecard case is probably just the juiciest one. Some of the banking sector issues previously predominantly typical for the Baltic countries have somehow shifted to Central European jurisdictions, and money from the FSU seeking new westward routes is seen as the main cause of those processes. Russian names among the UBOs of real estate, IMEX, energy and numerous FinTech companies, are also indicated as red ags by AML/CFT systems. The overcrowded Central European business environment makes it challenging to identify untrustworthy or simply dangerous third parties, and the understanding excessive multi jurisdictional information ows is a key to Read more